Image by Thomas Hawk via Flickr

Image by Thomas Hawk via Flickr

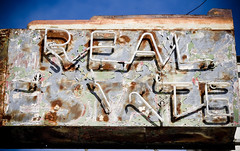

If you think investing in Commercial Real Estate in the form of a REIT (Real Estate Investment Trust) is still a good investment, once again, you are not paying attention. This is the market that could and, most likely will, spark a stock market crash in 2010 (Maybe sooner). Here's why!

Commercial buildings, office buildings, Malls and the like, are the lifeblood of the REIT market. Even before the advent of REITs, investing in commercial real estate brought investors and speculators fortunes. Mostly those investors were already rich or well to do because the average retail investor could not afford to be in this market. REIT's changed all that as they began to trade on the markets much like stocks. During the great depression, a number of distraught investors actually jumped from the same buildings they had invested in. Hopefully that won't happen next year, at least, not to you.

If you are invested in a REIT or similar commercial real estate company, there are some things you need to understand, and you need that information now, before things start to unravel even more than they did earlier this year. Yes, I know that, many pundits are very bullish on this market but as Warren Buffett has put it, "you pay a high price for a cheery consensus".

Now, don't take just my word, or anyone's word for it. Look around you! The last time you went to a mall, how many stores were closed, or closing? Indeed, how many malls are still surviving? Over 200 malls in the United States were abandoned this year alone. Now think back to the last few times you went into an office tower in your city for an appointment. Did you notice a number of empty offices or companies vacating the premises? As these properties financing comes due, where are they going to find new financing?

The banks have had a good run this summer. I know. I just sold much of my bank stock today. (when you have a good run you should not fall in love with the stock you own, even if it is a bank with strong earnings. In this case, TD). Banks, particularly those in the U.S., would be the "second" domino to fall if the commercial real estate crashes. It could even be a "death blow" for some banks as their exposure is over $2 Trillion dollars to the sector which could lose as much as $1 Trillion in value.

REITs trying to re-finance properties this fall and early next year, will run into a wall. No one will want to lend them the billions required to re-finance their operations, especially banks that have been propped up by government bailouts. This does not include the 80 banks that have failed this year, or the 200-500 expected to fail in the next 12 months. Yes, that many, and those are the conservative estimates. Some analysts believe the number is closer to 1,000. Even after all that has happened over the last 18 months, the banks are still holding their cash close. However, if your REIT has solid management, is flush with cash and is keeping their powder dry waiting for the downturn, you might wish to hold on to your shares. Only the strong will feast on the many carcasses that will be strewn across the landscape.

Trust has left this market place. It will leave behind it's offspring, pain and loss!

Update: Sept 10th 2009 from New York Times.

Corus Bancshares - First domino to fall.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0347b8ce-e771-4115-9765-3184fc4b38e4)

No comments:

Post a Comment