Natural gas can however, power the transportation of the future as feed stock for electrical power generation. Because natural gas is so abundant, it only makes commons sense that electric power plants will use more and more natural gas as their feed stock over time. As this abundant source of power generation comes on stream, look to invest in the companies that stand to benefit from this game changer.

Duke Energy (DUK), Progress Energy (PREX.PK) and others are all good bets as is laid out by theStreet.com (See their top ten list for 2012) Electric power storage is also a great place to take a long term view. There companies in that space looking for fuel cell solutions (large fuel cell stacks that can burn nat gas) Ballard Power (BLDP), Plug Power (PLUG), and Hydrogenics (HYGS) are all pursuing such a solution. However, it is the feed stock of the future electric car that interests me most, and that is Lithium.

As Lithium becomes more and more the "go to" source for new battery technologies, from your iphone and laptop, to golf carts, electric motor cycles, cars and large storage facilities, look to the miners who produce, or will produce, lithium carbonate from two different sources, hard rock (pegmatite) and lithium brines or clays. Let me explain.

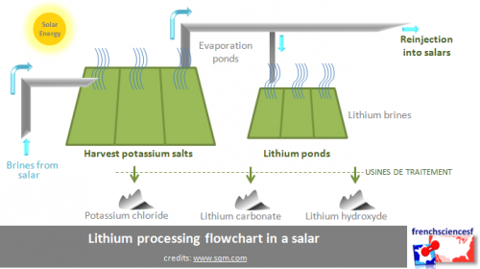

The largest supplier of Lithium today is Sociedad Qumica y Minera de Chile S.A. (SQM) which produces Lithium as a byproduct of its massive Potash operations. As with other large miners, SQM sells it's lithium on a spot market (there is currently no futures market for lithium, however this could change in the coming years)

Now electric battery manufacturers and car makers require a steady stream of lithium carbonate for their manufacturing processes so as not to interrupt production. To date, suppliers such as SQM, FMC et al have refused to sign contracts to supply a continuous, uninterrupted supply of product to manufacturers. This is mainly because, even though brine production is the most economical way to produce lithium, it is more sporadic than spodomen production, due to the natural drying out process supplied by the sun, that makes it more economical in the first place.

Australian producer Talison Lithium (TLTHF.PK) (TLH-T) is the largest, pure lithium producer on the planet, and its spodomen production from its Greenbushes operation in Western Australia, is the richest hard rock deposit on the planet. Talison supplies over 300 customers with product and is the largest supplier to the growing Chinese market, due to its ability for continuous production and its proximity China. Talison also boasts a very large brine deposit in South America due to its purchase of Salares Lithium in 2010. In 2012 Talison reports a 25% increase in the price of lithium this year alone (2012).

(click to enlarge)

FMC Corporation (FMC) is another large producer based in South America, with brine production as a byproduct of other operations such as potash. As with SQM, lithium is only a part of its total operations and as potash becomes more important as agriculture attempts to feed a hungry world, its share price looks attractive as well.

As the lithium market grows, you should not ignore the juniors who have popped up over the past five years to take advantage of large deposits which may at some point, be quite productive or gain the notice of larger producers as consolidation takes place, as it so often does in young, growing markets.

In this space I like both Western Lithium (WLCDF.PK)(WLC-T) for its large, Kings Valley clay deposit in mining friendly Nevada and Rodinia Lithium (RDNAF.PK) (RM-T) as it owns three of the top 20 lithium brine deposits on the planet. If there is a future consolidation in the industry, these two should be tops on the majors lists.

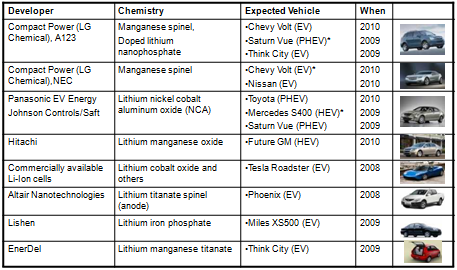

In the "Battery" tech area I like A123 Systems (AONE). At only .50c per share this high tech battery maker has been hammered this year, well below where I think it should trade. At .50c per share, it is one of the best speculative penny stocks out there.

The above chart shows some of the other companies working in this field and as you can see from the chart, Lithium is a common denominator in battery development.

UPDATE: Aug 24th 2012

Rockwood Holdings (ROC) made an offer for Talison Lithium of $724 Million driving Talison shares up by 53% since yesterdayès close. We have cashed out our position in Talison with 110% gain. Looking for an entry point into ROC now as it strengthens itès already substantial position as a world leader in the production of Lithium!

Editor

No comments:

Post a Comment