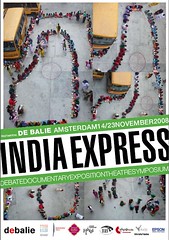

Image by De Balie via Flickr

Image by De Balie via Flickr

No matter the last 15-20 years of supposed free market reforms, China is still a communist country with democracy only a distant dream! Time and again, they have proven that the rule of international law does not apply to their country. Copyright infringement is rampant and far reaching, graft is still part of local and national government business, and as for human rights, well, they don't apply. Lately, the country's leadership has been working, through the proxy of it's nationally owned companies, to soak up much of the worlds raw material, from oil and gas, to fertilizer, coal, and ingredients for making steel.

No supposed "free marketer" dares to challenge policy in China, for fear of being ostracized by the great, red, business machine. Just ask Google! Ominously, the recent run up in the Chinese markets is driven mostly be inexperienced Chinese investors, with visions of sugar plums dancing in their uneducated investment heads. That can only end badly with many of them learning the hard way that what goes straight up, always comes down. In the final analysis, will the rules of business, be guarded by the rule of law? Maybe, but, contrary to many other wide eyed investors, I'm not putting my money on it, or into China.

Russia has a shrinking population, a suspect banking system and clings to a Government structure of "strong man rule" under the guise of democracy. Russia has proven time and again, that they have more crime bosses, than CEO's. Just ask any of a dozen good companies who have arrived from the west during the past 15 years, only to be cheated out of billions in real estate, oil, gas, you name it. The names of these business are too numerous to mention, but they certainly know who they are. Or ask any of a number of honest journalists who have challenged the status quo in that country (Oh, sorry, you can't ask them, because they are dead).Until a proper democracy and the rule of law replace King Putin, I won't be risking any of my meager Retire funds there either.

That, my friends, leaves us with half a BRIC!

India is the "largest democracy in the world", and it just elected a very pro business government that cannot be voted out of office for the next five years. Companies like Tata Motors, Taj Hotels and Resorts, Bajaj Holdings & Investment, Nadir Godrej-led Godrej Industries and lender "Yes Bank" may well be the Microsoft, P&G or Google of the 21st century. Business Week certainly seems to think so! India has a disproportionate number of the worlds software engineers as is evidenced by the number of Indian nationals who emigrated to Silicon Valley during it's heyday, and who now are back in India leading cutting edge companies. Does India have it's problems? Sure it does, but during this global recession, what country doesn't? Exactly! Many believe that India is right now, where China was 20 years ago with regard to business development. Does this sound like a good prospect for your retirefund? It does to me. You can buy a pure Indian Fund on the NYSE.

Brazil is already, so far ahead of the rest of the world in green energy production that it is entirely self sufficient. Besides owning great reserves of oil, almost 50% of it's energy is derived from locally produced ethanol, and they are, far and away, the world leaders in this technology. In Aerospace, Embraer, is a world leader in the building of regional jets in competition with Canada's Bombardier. Banco do Brasil is not in nearly the jam that many American Banks find themselves in, and other companies such as Brazil Telecoms (telecommunications) and Braskem (chemicals) are now on international investors radar screens. Yes, they also have their problems, but they are a growing phenomenon, and Brazil is also a democracy.You can buy a Brazil Fund currently on the NYSE.

Now if we can just get the fund managers to come up with a basket of great companies from these two emerging powerhouses, you might be able to throw just half a BRIC into your Retirefund, and reap the rewards.

Are you listening IShares?

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=536e8d22-7331-4c0a-bbd2-f16ab1b3ac66)

No comments:

Post a Comment